📅 Published on August 23, 2025

✍️ By SevenFeeds Editorial Team

Table of Contents

Toggle(Quick Takeaways)

- 📈 Bitcoin crossed $94K, overtaking Google to become the 5th largest global asset.

- 🏦 Institutional adoption (ETFs, pension funds, insurers) is fuelling demand.

- ⚖️ 2024 halving and Fed rate cut bets pushed supply-demand imbalance.

- 🌍 Bitcoin now sits beside Apple, Microsoft, and gold in global rankings.

- 🔮 Future outlook: Possible $100K+ price and stronger regulation ahead.

Why This Milestone Matters

Bitcoin as a Mainstream Asset

This wasn’t just a short-term rally. Crossing $94K pushed Bitcoin’s market cap to $1.86 trillion—bigger than Amazon, Meta, and Google.

It matters because:

- Crypto went mainstream: from hedge funds to retail traders, everyone’s involved.

- Scarcity rules: with only 21M coins, Bitcoin’s digital scarcity mirrors gold’s physical scarcity.

- Macro tailwinds: Fed rate cuts, inflation, and dollar weakness boosted Bitcoin’s appeal.

Deep Analysis: How Bitcoin Surpassed Google

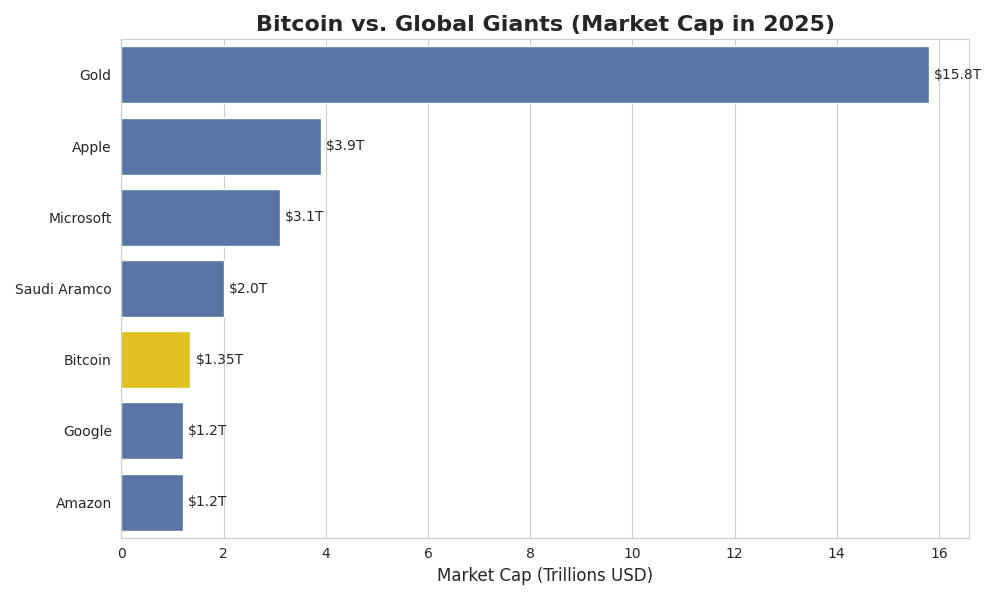

Market Cap Snapshot

- Bitcoin: $1.86T (Aug 2025)

- Google (Alphabet): $1.83T

- Amazon: $1.78T

- Meta: $1.16T

(Source: CoinDesk)

Bitcoin now sits behind:

- Gold

- Apple

- Microsoft

- Saudi Aramco

Institutional Adoption Is Key

- Bitcoin ETFs absorbed billions in inflows this year.

- Pension funds and insurers included Bitcoin in diversified portfolios.

- Banks & fintechs onboarded customers into crypto services.

💡 Pro Tip: Watch ETF inflows—they’re a strong signal of institutional confidence.

Halving Cycles Driving Supply Crunch

The 2024 halving cut miner rewards, reducing supply. Historically, halvings = bull runs:

- 2012 → $12 → $1,000

- 2016 → $650 → $19,000

- 2020 → $8,000 → $69,000

- 2024 → Current rally beyond $94,000

Bitcoin’s Journey to the Top 5 Assets (2013–2025)

Bitcoin’s path to today’s ranking wasn’t smooth—it was filled with hype, crashes, and comebacks.

- 2013 → $13B market cap — The first time Bitcoin grabbed headlines.

- 2017 → $240B — The ICO boom fuelled mainstream awareness.

- 2020 → $500B — Post-COVID institutional adoption began.

- 2021 → $1T — Bitcoin crossed the trillion mark for the first time.

- 2022 → $400B crash — Harsh winter, bankruptcies, regulatory crackdowns.

- 2025 → $1.35T+ — Now officially among the Top 5 global assets.

👉 Insight: Bitcoin isn’t just surviving—it’s outlasting giants once thought untouchable.

Storytelling: My First Encounter with Bitcoin

Back in 2017, when Bitcoin was just $3K, I remember friends laughing at the idea it could rival Apple or Google.

Fast forward to 2025: those same skeptics are now asking if they’re too late. To me, Bitcoin’s rise is proof that innovation often looks crazy until it becomes history.

Predictions: What’s Next for Bitcoin?

- 🚀 $100K+ in 2025? Momentum + ETF demand could drive it higher.

- ⚖️ Tighter regulation — Governments won’t ignore a $2T asset.

- 🪙 Rivalry with gold — Bitcoin may slowly eat into gold’s $14T dominance.

- 🌍 Nation adoption — More countries may explore Bitcoin as legal tender.

💡 Pro Insight: Bitcoin could evolve into a digital macro hedge—part bond, part gold.

Actionable Takeaways for Investors

If you’re considering exposure:

✅ Avoid chasing hype — enter with discipline.

✅ Diversify — don’t make Bitcoin your entire portfolio.

✅ Use secure wallets — cold storage like Ledger or Trezor.

✅ Stay informed — regulation can swing markets fast.

✅ Think long-term — Bitcoin rewards conviction, not panic.

📌 CTA: Don’t wait for the next parabolic run—plan your crypto strategy today.

FAQs on Bitcoin Becoming the Fifth Largest Asset

Conclusion: The Era of Bitcoin as a Global Asset

Bitcoin surpassing Google isn’t just a financial milestone—it’s a symbolic revolution. The first decentralised asset now shares space with trillion-dollar giants.

The question isn’t if Bitcoin matters. It’s how you’ll adapt your strategy in a world where digital assets are reshaping wealth.

📌 Read also on SevenFeeds

External Links

Author Bio

👤 About the Author

SevenFeeds Editorial Team explores crypto, AI, and cybersecurity with insights backed by research, credible sources, and real-world case studies. Our goal: to make trends clear, trustworthy, and actionable.