Table of Contents

ToggleRead Quickly

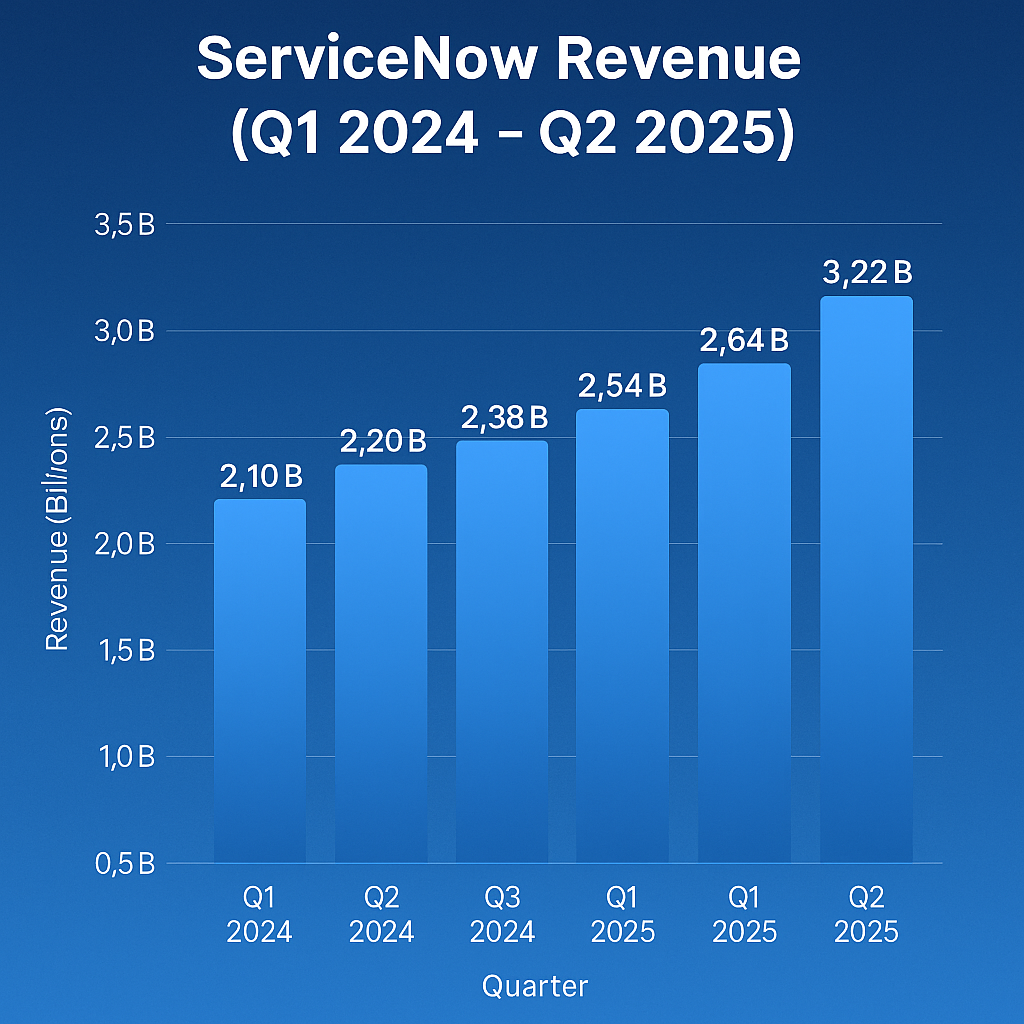

- 🚀 $3.22B Q2 revenue (+22% YoY)

- ☁️ $1.2B Google Cloud deal strengthens AI backbone

- 🤝 $2.85B Moveworks buy adds AI assistant expertise

- 🏎 Ferrari partnership shows real-world, high-speed deployment

- 💰 $100M in internal savings prove ROI

- 📊 Outpacing Salesforce with agentic AI

Introduction

Imagine an IT ticket that doesn’t just alert a support agent but diagnoses and fixes itself. Or an HR onboarding process where paperwork, approvals, and provisioning all happen automatically — no human chasing required.

That’s the future the ServiceNow AI Platform 2025 is shaping. As CEO Bill McDermott put it, “The second wave of AI is not coming — it’s already here.” Unlike peers still testing AI as an add-on, ServiceNow has gone all in: re-engineering its platform around AI-first workflows.

This article breaks down how that shift is playing out across:

The rise of agentic AI (autonomous AI agents that act, not just suggest)

A $1.2B Google Cloud partnership

The $2.85B Moveworks acquisition

Case studies — from Ferrari’s racing ops to ServiceNow’s own $100M savings

From Workflow Tool to AI-First Platform

ServiceNow is no longer positioning itself as “just a workflow engine”. The new ServiceNow AI Platform 2025 is powered by agentic AI — meaning tasks are executed automatically, not queued for humans to handle.

Where this shows up:

IT Service Management (ITSM): Tickets resolved proactively before hitting an agent.

HR Onboarding: Full-cycle automation from forms to equipment requests.

Security Ops: Threats identified and neutralised in real time.

👉 The difference? Legacy CRMs like Salesforce often rely on AI overlays that generate insights, but humans still need to take action. ServiceNow’s approach shortens the gap between insight and execution. For CIOs, that means fewer bottlenecks and faster ROI.

Q2 2025 Earnings: Proof in the Numbers

The company’s financials suggest this isn’t just hype:

- Revenue: $3.22B (+22.4% YoY)

- Subscription Revenue: $3.11B (+22.5% YoY)

- EPS: $4.09 (beating estimates by $0.52)

- Mega Deals ($20M+ ARR): Up 30%

📌 Interpretation: The numbers indicate not only top-line growth but also customer trust in AI-first workflows. Investors are rewarding this momentum — ServiceNow stock has outperformed many SaaS peers in 2025.

Instead of simply “automating”, enterprises are now asking: how fast can we scale AI into mission-critical workflows?

The $1.2B Google Cloud Deal: An AI Backbone

In July 2025, ServiceNow inked a $1.2B multi-year partnership with Google Cloud. More than just hosting, the deal strengthens ServiceNow’s AI muscle:

- Global Scale: AI workloads distributed seamlessly across geographies.

- Low-Latency Compute: Enabling automation at enterprise scale.

- Google Gemini Integration: Direct access to Google’s next-gen AI stack.

This move gives ServiceNow an ecosystem edge: pairing Google Cloud’s infrastructure with ServiceNow’s workflow AI and Moveworks’ assistant tech creates a vertically integrated AI platform for enterprises.

Moveworks Acquisition: $2.85B Bet on AI Assistants

In one of 2025’s boldest SaaS acquisitions, ServiceNow bought Moveworks for $2.85B. What did it gain?

- A team of 500+ AI engineers

- Proven AI assistants already used across IT & HR

- Deep adoption in Fortune 500 enterprises

Instead of Moveworks’ PR framing, let’s put it plainly: this was a scale play. ServiceNow gets domain-specific AI assistants and talent; Moveworks gets enterprise reach and infrastructure.

By Q4 2025, expect Moveworks-powered assistants baked directly into ServiceNow — handling IT tickets, HR requests, and even cross-department workflows natively.

Ferrari Partnership: AI workflows powering elite engineering ops

Sure, seeing Ferrari as a client makes for glossy slides. But here, the partnership is functional. Ferrari uses the ServiceNow AI Platform 2025 to optimise:

Hypercar engineering workflows

Race-day operations where milliseconds matter

Collaboration across global teams

📌 Insight: This shows AI workflows aren’t confined to back-office tasks — they’re now mission-critical even in high-performance environments like Formula 1.

ServiceNow as Its Own Case Study: $100M in Savings

To prove ROI, ServiceNow doesn’t just cite customers — it points to its own operations. Running its AI stack internally, it expects $100M in hiring cost savings for 2025, driven by:

- Automated employee support

- Faster IT/HR resolutions

- Reduced onboarding and training costs

This reinforces the narrative: ServiceNow is both vendor and proof point.

Why Legacy CRMs Should Worry

While peers patch AI onto legacy stacks, ServiceNow built AI into the foundation.

📊 Agentic AI vs Generative AI (Overlay)

| Aspect | Legacy CRMs (GenAI Add-ons) | ServiceNow (Agentic AI) |

|---|---|---|

| AI Integration | Overlay on workflows | Natively embedded |

| Primary Use | Summaries, drafts | End-to-end automation |

| ROI | Soft metrics | $100M+ hard savings |

| Scalability | Limited | Enterprise-wide |

📌 Reality check: ServiceNow isn’t experimenting. It’s already operating as an AI-first company.

Global Adoption: City Spotlight

- India: BFSI & IT majors in Bengaluru cut onboarding costs with AI.

- Europe: German automakers and Dutch logistics firms automate complex workflows.

- U.S.: Healthcare providers and public agencies pilot agentic AI at scale.

📌 Regulatory Fit: Compliance with the EU AI Act and India’s DPI framework helps ServiceNow clear adoption hurdles faster than peers.

Future Outlook: What’s Next?

Looking ahead:

- 2026: AI workflows expand into finance & supply chain.

- 2027: Analysts project a $10B+ AI-driven SaaS market with ServiceNow in the top three.

- Long-term: AI, cloud, and workflows converge as the backbone of enterprise IT strategy.

Final Thoughts

The ServiceNow AI Platform 2025 isn’t just a marketing pitch — it’s producing:

Hard ROI ($100M+ savings)

Broad adoption (from BFSI to Ferrari)

Investor confidence (22% YoY growth)

For CIOs, founders, and enterprise leaders, the lesson is clear: the second wave of AI isn’t coming. It’s here. And ServiceNow is leading it.