Table of Contents

ToggleQuick Summary

- AI crypto trading bots shifted from rigid rule systems to models that analyze price action, on-chain flows, and sentiment in real time.

- Nansen launched a new AI trading chatbot in 2025 powered by Anthropic’s Claude, built for traders who want live intelligence without coding.

- Grid, mean reversion, and ML-based momentum strategies remain reliable in 2025 when paired with solid risk controls.

- Risks include model hallucination, overfitting, MEV attacks onchain, and blind trust in black box logic.

- This guide explains AI bots, how to deploy one safely, and tools worth testing.

Why Nansen’s AI Launch Matters

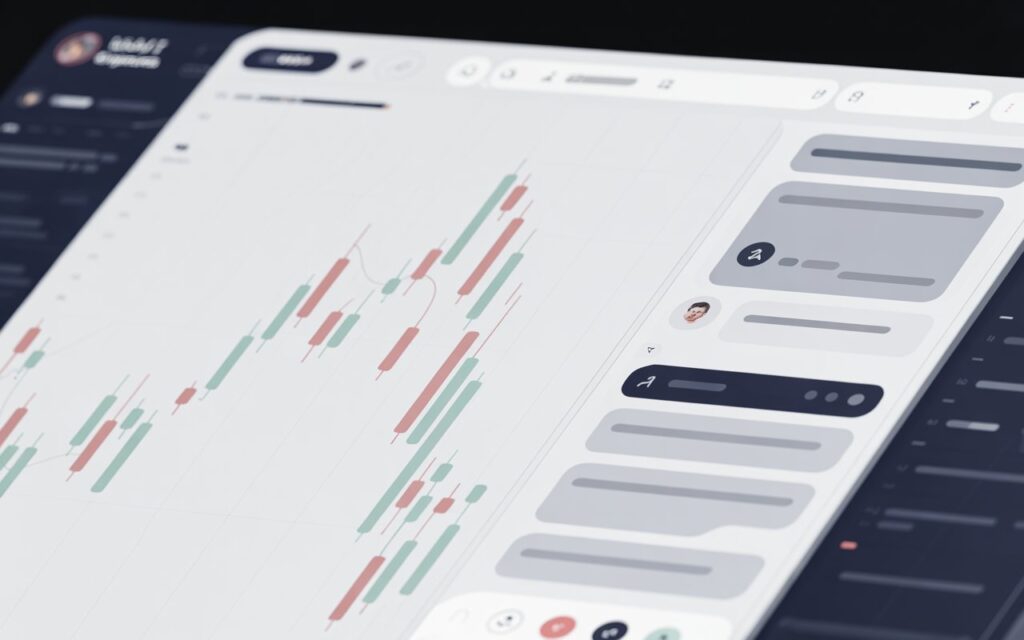

AI in trading has existed for years, but early versions were limited. They could execute trades automatically, but they couldn’t interpret messy real-world factors like retail sentiment, whale movement, or flow between wallets and exchanges.

That changes in 2025.

Nansen released an AI trading assistant that lets traders ask natural-language questions such as:

- “Which wallets are accumulating ETH this week?”

- “Show me where smart money exited last cycle.”

- “Compare capital rotation across L1 networks.”

The assistant is built on Anthropic’s Claude family with Nansen’s proprietary on-chain datasets layered in. The result is an interface that feels less like a dashboard and more like a research partner.

With institutional spending on AI increasing across finance (IDC estimates budget growth of more than 35 percent in 2025), consumer-grade access to this level of intelligence is arriving fast. For retail traders, that means less guesswork and fewer emotion-driven decisions.

How AI Crypto Trading Bots Work: Behind the Curtain

Most modern trading AI reads several categories of data:

| Data Type | Examples |

|---|---|

| Price Action | OHLC, volatility, order books |

| Sentiment | X activity, search trends, FUD spikes |

| On-Chain | Wallet flows, exchange transfers, accumulation |

| Macro Signals | Rates, funding, liquidity indices |

Instead of reacting to a single indicator, the bot evaluates multiple signals and chooses the highest-probability trade.

This is closer to how a professional human trader thinks.

Setting Up an AI Trading Bot (Step-by-Step)

Whether you choose Nansen, Cryptohopper, Bitsgap, or a home Python script, the deployment workflow is similar.

1. Choose your exchange

Top options:

- Binance

- Bybit

- Coinbase Advanced

- OKX

Use API keys with:

- Trading enabled

- Withdrawals disabled

This is standard risk protection.

2. Decide what data powers the bot

If the bot only sees charts, it’s blind to everything else.

Most profitable systems combine:

- Exchange books

- On-chain intelligence (Nansen, Glassnode)

- Social patterns

- News sentiment

- Volume and long/short ratios

This multi-signal approach improves decision accuracy dramatically.

3. Select your trading strategy

Here are the strategies working best in 2025:

1. Grid Trading (still highly effective)

Works best in sideways or high-volatility markets.

- Buy lower

- Sell higher

- Repeat automatically

According to NASSCOM, grid bots outperform manual trading in stable ranges because humans over-manage entries while bots execute reliably.

2. Mean Reversion

Assumes price eventually returns to its average.

Indicators:

- Bollinger Bands

- RSI

- Moving average divergence

Best used with a strict stop loss to avoid blowouts during breakout trends.

3. Momentum + Machine Learning

AI models look at:

- Wallet activity

- Order book pressure

- Volume anomalies

- Funding rate changes

Goal: catch the early stages of a real move, not chase late entries.

4. Fusion: On-Chain + Social

Some advanced bots combine:

- Whale accumulation

- Twitter sentiment

- Exchange positioning

- Token rotation

- Media coverage

This hybrid approach is how large hedge funds already trade.

4. Backtest before running live

A real backtest should show:

- Sharpe Ratio

- Max drawdown

- Profit factor

- Performance during 3 market types

If a strategy only works in bull markets, it’s not truly a strategy.

5. Deploy live with capital controls

Start with:

- Paper trading

- Small sizing

- Live supervision

Even the best automation benefits from human judgment.

Sample Execution Code (Just for Understanding)

client.new_order(

symbol=”ETHUSDT”,

side=”BUY”,

type=”MARKET”,

quantity=0.5

)

This is what bots send to exchanges under the hood.

Tools Worth Testing

🔹 Nansen AI (recommended for research)

Provides structured on-chain intelligence with a natural-language interface.

🔹 Cryptohopper (full automation)

Supports:

- Backtesting

- Marketplace signals

- Multi-exchange trading

- Strategy templates

🔹 Glassnode + Nansen (elite combination)

- Glassnode for exchange flow + trader metrics

- Nansen for wallet profiling

Combined, you see both micro and macro structures.

⚠️ Risks You Should Not Ignore

AI trading is powerful but not perfect.

Hallucination

AI could deliver confident but wrong answers if not grounded in real data.

Overfitting

A model trained on past bull cycles may fail in sideways or bear markets.

MEV and front-running

On-chain execution can be manipulated by bot watchers.

Black-box execution

If the system can’t explain why a trade happens, you can’t diagnose failure.

These risks are real and should be in your playbook.

Personal Insight

I’ve tested automated systems since the last cycle. The traders who consistently win aren’t the ones with the most complicated bots. They’re the ones who:

- Manage risk

- Avoid emotional intervention

- Stay consistent

- Improve strategy with data, not impulse

AI improves speed and clarity, but discipline still matters more than code.

X (Twitter) Insight

“AI trading isn’t replacing traders. It’s replacing the traders who rely on emotion, not data.”

This sentiment is trending among professionals who already rely on automated execution workflows.

📈 Starter Portfolio Allocation (Example)

| Allocation | Purpose |

|---|---|

| 60% | Main automated strategy on BTC/ETH |

| 20% | High-volatility alt strategy |

| 10% | Manual discretionary trades |

| 10% | Cash reserve |

Not financial advice—just a structure many automated traders use to avoid over-exposure.

Future Outlook

AI agents will evolve fast from “advisors” to fully autonomous trading operators capable of:

- Identifying opportunities

- Executing trades

- Hedging risk

- Halting positions in black-swan events

- Adjusting strategies autonomously

In the next 24–36 months, expect:

- More retail-friendly execution tools

- On-chain bots that avoid MEV

- Social + on-chain sentiment engines

- Brokers offering “AI portfolios”

- Trading models that update in real-time

The winners will not be the traders who simply adopt AI—

but the ones who learn how to work with it.

Final Thoughts

AI trading in 2025 is shifting from mechanical automation to insight-driven decision support. Tools like Nansen provide a view into capital flows and on-chain behavior that retail traders rarely accessed before.

But automation is not the objective. Better decision quality is.

The traders who combine AI-driven research with structured risk rules and disciplined execution will have a real edge this cycle.

Who We Are

Sevenfeeds publishes practical crypto explainers, tooling reviews, and hands-on trading guides written for traders who want clarity without hype. Every piece aims to be useful, data-backed, and easy to apply in the real world.

FAQ — AI Crypto Trading Bots

They can be, but returns depend on market conditions, model quality, and proper risk controls.

No. Many platforms allow non-technical users to trade automatically.

It’s safe if you use secure API keys, test strategies, and monitor live execution.

Most traders begin with small allocations or paper trading before scaling.

Major exchanges like Binance, Bybit, OKX, and Coinbase support API automation.