October 2025 is proving to be one of the most volatile—and opportunity-laden—months for crypto. The bitcoin price has already shattered records, and macro shifts are threatening to push it either higher or lower. If you want to ride this wave smartly, here’s everything you need to know.

In this article, we’ll connect the dots: tariffs, crashes, expert forecasts, and what’s likely ahead. Let’s dive deep.

Table of Contents

Toggle📈 October’s Breakout: Bitcoin Price Hits New Highs

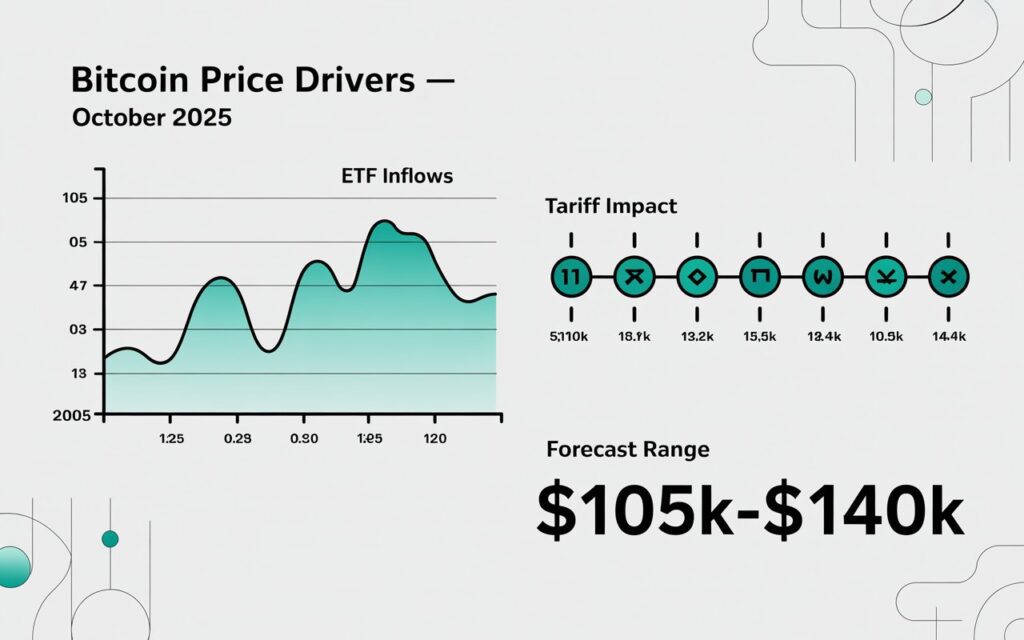

At the start of October, bitcoin price surged past $116,000, and by October 5 it had crossed $125,000 — a record high. (Reuters)

This rally was built on solid fundamentals:

- ETF inflows of $5.95 billion globally in one week.

- Institutional capital pouring in from the U.S. and Europe.

- A weakening dollar and rate-cut expectations are fueling crypto appetite.

💬 “$5.95 billion in ETF inflows shows institutions aren’t just back — they’re doubling down,” noted a Bloomberg analyst on October 7.

Even retail traders from India and Southeast Asia joined the run, marking global participation unseen since 2021.

⚠️ Mid-Month Crash: Why Bitcoin Price Dropped

Trade War & Tariff Shock

The sudden announcement of 100% tariffs on Chinese tech imports by the U.S. sent global markets into panic. (LiveMint)

Crypto took the hit first: $19 billion in value evaporated overnight, and bitcoin price fell nearly 8.4%.

Leverage Cascade

Many traders were over-leveraged. When prices dipped below $115,000, it triggered a liquidation chain reaction, adding to the free-fall. (TradingView)

Sentiment Shift

Capital rotated from altcoins and DeFi into stablecoins and cash. The “risk-off” mood dominated, especially after Trump’s tariff tweet on October 10 went viral across X (formerly Twitter).

🐦 @CryptoQuant: “$16B in longs liquidated in 48 hours — markets repricing risk faster than expected. #BitcoinPrice #CryptoCrash”

🔮 Forecasts & Projections: Where’s Bitcoin Price Heading?

Bullish Scenario

- Analysts predict $140K–$145K by month-end if momentum and ETF inflows persist.

- Changelly models a stable band between $119,800–$126,600.

- Institutional accumulation (BlackRock, Fidelity ETFs) continues to tighten supply.

Bearish Scenario

- If support at $120K fails, bitcoin price could retest $105K–$110K.

- Macro tightening or new geopolitical shocks may cause another sharp drawdown.

Balanced Outlook

Volatility defines October. Holding $120K–$122K could pave the path to $130K+; dropping below $110K risks revisiting mid-summer levels.

🧠 Trend Matrix: 3 Factors Moving Bitcoin Price

| Trend | Impact on Bitcoin Price | Watchpoints |

|---|---|---|

| ETF Inflows & Institutional Demand | Sustains upward pressure; structural liquidity | Sudden outflows or profit-taking |

| Macro Shocks (Tariffs, Rates, Policy) | Short-term volatility, sentiment reversal | Trade tensions, USD strength |

| On-chain & Miner Behavior | Low exchange outflows = bullish | If miners start selling heavily |

🧩 Real-World Case Studies

MicroStrategy: Added 14,000 BTC in Q3 2025 — now holding over 150K BTC, signaling continued corporate conviction.

BlackRock IBIT ETF: Saw $969 million inflow in a single day, influencing short-term price spikes.

Retail Asia: India’s CoinSwitch reported a 28% increase in retail Bitcoin purchases during dips — a signal of regional strength.

These cases illustrate why bitcoin price movements reflect layered ecosystem behavior, not just speculation.

🌍 Global Snapshot: Regional Trends

- U.S. & Europe: Institutional demand and ETF arbitrage dominate.

- India & SE Asia: Retail and peer-to-peer activity rise during dips.

- Latin America & Africa: Bitcoin adoption as inflation hedge intensifies.

📊 “In India, retail buying rose 34% week-on-week even as global prices fell,” — NASSCOM Blockchain Report 2025.

⚖️ Balancing Opportunities & Risks

Upside:

- ETF inflows and accumulation patterns favor long-term strength.

- Weakening dollar enhances appeal as digital gold.

Risks:

- Macro shocks (tariffs, Fed decisions).

- Over-leverage and emotional retail behavior.

- Possible miner capitulation under stress.

Pro Tip: Use layered entries, stop-losses, and monitor on-chain data (Glassnode, Chainalysis) for early signals.

🧭 Final Outlook & Call to Action

October 2025 will be remembered as the month Bitcoin tested institutional faith and macro resilience. The bitcoin price is no longer just a trader’s metric; it’s a geopolitical barometer.

💡 What to Do Next:

- Read our follow-up: Top Tokens to Invest in October 2025

- Subscribe for weekly crypto market breakdowns

- Share your forecast below — will we see $140K or $100K next?